How Document Verification Strengthens KYC and Prevents Identity Fraud

In the modern era of rapid and digital economy, companies are becoming more and more online, and the authenticity of the identities of the customers has become a burning issue. Due to the increasing number of digital onboarding and remote transactions, the threat of identity fraud has increased. Through the use of false or modified documents, criminals utilize them to open accounts, to launder money or to engage in financial crimes. Document verification has become an essential part of the Know Your Customer (KYC) process to overcome these threats and provide organizations with an opportunity to check the identities of their customers in the most effective and correct way.

Increasingly Importance of Document Verification in KYC

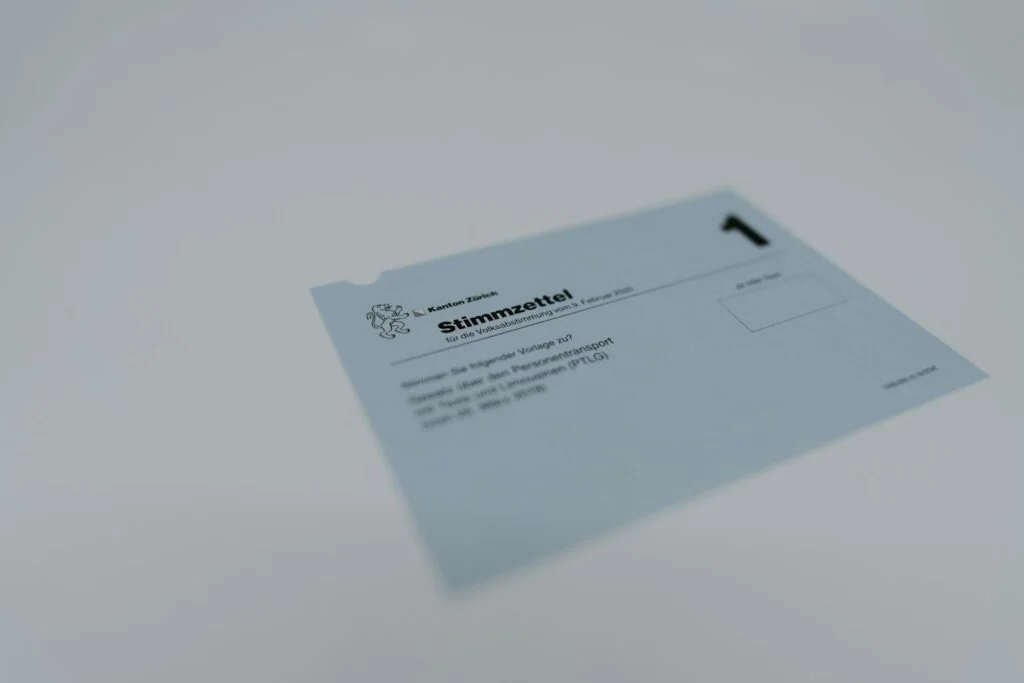

KYC is a regulatory and operational model that aids financial organizations and companies in ensuring that they are dealing with the identity of their clients prior to rendering services. Conventionally, KYC was done by using manual verification, which was done through the physical verification of documents like passports, ID cards and utility bills. Nevertheless, manual verification was not feasible and prone to error with the emergence of remote onboarding and digital transformation.

This is where the verification of documents digitally comes in. With the help of artificial intelligence (AI), machine learning (ML), and optical character recognition (OCR) technologies, nowadays enterprises can check documents and identify inconsistencies, forgeries, and manipulations in real time. This automation will guarantee that the international AML (Anti-Money Laundering) regulations are adhered to and will improve the customer experience by accelerating the onboarding process.

The Operation of Document Verification

The verification of the documents in the modern world is a multi-layered process aimed at verifying the authenticity of identity documents and aligning them with the person presenting them. Here’s how it typically works:

Document Upload: The user uploads a picture or a scan of his/her identification document (e.g. passport, driver’s license or national ID).

Data Mining: Sophisticated OCR tools are used to extract the data key including name, date of birth and ID number.

Authenticity Checks: The system analyses the structure, format, holograms and fonts, among other security items to estimate any form of tampering or forgery.

Liveness Detection: The user can be requested to take a selfie or take a short video to ensure that he/she is physically available and that he/she matches with the picture of the ID.

Cross-Verification: The data obtained is cross-verified with reliable databases or watchlists as an additional measure.

It is an automated and layered method that guarantees not only accuracy but also speed so that a business may onboard actual users, but it also blocks bad actors.

Read Also: Why Smart Technology and Solar Go Hand-in-Hand

Enhancing KYC by Automation and Precision

The process of document verification is very essential in the improvement of the KYC processes through automation, accuracy, and scalability. Human error and slowness of manual KYC checks are a thing of the past, whereas automated document verification solutions can check several thousand verifications within a second.

Organizations gain by incorporating document verification into the KYC processes by:

Better compliance: Automation will make sure businesses adhere to local and international laws, including FATF, GDPR, and AML guidelines.

Less Human Error: A machine-based verification lessens the possibility of oversight, and has uniform results.

Reduced Onboarding Time: The time required to verify customers can take a few minutes and thus improves their experience, which in turn lowers their drop-off rates.

Cost Efficiency: Automation reduces operational expenses relating to review manual teams.

All of these advantages contribute to making the KYC process more powerful, as companies do not need to sacrifice the convenience of users.

Avoiding Identity Fraud through Document Verification

One of the most prevalent and most expensive types of cybercrime is identity fraud. When committing fraudulent acts, fraudsters often place their forged or stolen documents in order to impersonate legitimate users, unauthorised access to services or to launder illegal money. When done well, document verification will aid in eradicating such crimes by averting fraudulent attempts at an early stage of the onboarding process.

The sophisticated checking tools can detect even the slightest signs of fraud, like one font type and another, or digital changes or the presence of the same ID number. Also, AI-based verification systems are able to adapt by learning new methods of fraud and improve accuracy. Together with biometric verification (e.g. facial recognition), document verification produces a safe multi-factor identity check and makes criminals almost impossible to evade.

As an example, a scammer can seek to open a digital bank account with the help of a good quality counterfeit passport. The forgery might not be detected with the hand review. Nonetheless, a document verification mechanism based on AI would immediately identify anomalies, i.e. inconsistent microprint, or modified MRZ (machine-readable zone) information, which would stop fraudulent onboarding.

Use Cases Across Industries

Although document verification is critical in banking and other financial institutions, its uses are much more than what mainstream finance may assume. Various sectors have automated verification to ensure that their operations are safe and secure users:

Fintech & Digital Banking: Will guarantee safe customer onboarding and transaction monitoring.

Cryptocurrency Exchange: Assists in fulfilling AML/CFT requirements and avoids the creation of fake accounts.

Healthcare: To ensure privacy of sensitive medical information, it authenticates patient identities.

E-commerce/Gig: Enforce the legitimacy of the seller and buyer to avoid fraud.

Travel & Mobility Services: How it works: Verifies passports/driving licenses to make secure bookings.

The document verification, in all these situations, provides an additional level of trust and accountability, minimizing the risk of fraud and ensuring compliance with the regulatory requirements.

The Future of Document Verification

Document verification technologies are developing at a high rate as fraud in identity becomes more sophisticated. The use of AI and blockchain is likely to be more instrumental in document integrity and traceability. Decentralized identity (DID) frameworks can be used in the future to enable users to manage their identity information safely but share only the required information.

In addition to that, governments and regulators are driving towards digital identity standards that will streamline and make document verification still more secure. These innovations will allow the businesses to check the customers with less friction and with a greater accuracy in a shorter period of time.

Conclusion

The verification of documents has become an essential part of the contemporary KYC procedures. It secures compliance as well as helps organizations to fight the increasing risk of identity fraud by using automation and sophisticated analytics. In the world that is increasingly digitizing, it is no longer a choice that business enterprises invest in high-quality document verification software, but it is a necessity to gain trust, provide security, and protect a customer and an institution during the digital era.